All You Need To Know Before Investing In Commodities

Ever since commodities have been identified as trading instruments, investors have been allocating some assets to commodities. Commodities are now valued as investments.

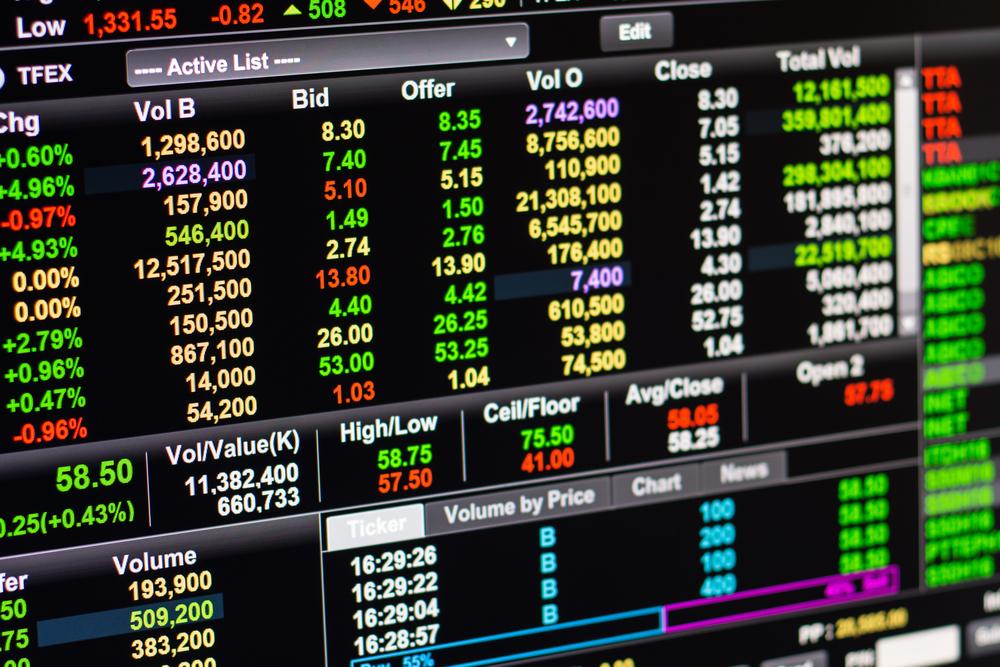

A commodity is a good that can be used for business purposes and exchanged for other commodities of the same type. A futures contract is the most preferred way of investing in commodities. It refers to an agreement to buy or sell a specified commodity in the future.

Is investing in commodities a good idea?

These days, the investors are realizing the value associated with commodity trading. As a result, commodity trading is gaining importance. A few global commodities are attracting investors with excellent returns. Exchange-traded funds (ETFs) have made it easier to invest in commodities for an average investor. Although commodities outperform the markets at times, several factors lead some investors to believe that one should not invest in commodities.

No interest or dividends

The commodity market works on the principle of demand and supply. Unless there is a demand, the commodity market will not work. Unlike stocks and bonds, commodities do not offer any interests or dividends to investors.

Good price not guaranteed

Commodities trading is speculative by nature. Moreover, an investor always looks for the liquidity factor, which is missing with commodities. Secondly, commodity trading lacks transparency, which affects returns and price.

Cannot be used as a hedge

Commodities futures offer a hedge against inflation. To reduce portfolio risk, portfolio managers hedge commodities. However, commodities are not the right hedge for S&P 500 owing to their speculative nature.

Overhead costs

Commodities are physical in nature like gold, crops, or metals. For instance, to protect any loss or theft, gold needs to be kept in a safe place or insured. This increases the overall cost of the commodity.

Risk factors

Risks are present in all investments. Commodities are no different. Commodities are dealt on futures markets, where prices can go up or down. A commodity broker or trader executes commodities orders, such as gold, crude oil, metals, or agricultural products, for futures contracts. When it comes to commodities, if you take more risk, you may earn high returns.

One can invest in commodities by purchasing physical raw commodities such as metals or steel. Another way of investing in them is through futures contracts or exchange-traded products (ETPs). Through ETPs, an investor can save the cost of diversifying when they remain invested over the long term.

Even though commodities are riskier bets for new investors, fund managers advise allocating a small portion of earnings to commodities. Invest in commodities through fund managers to earn good returns over a period of time by purchasing diverse commodities. Investors are bullish on gold and other precious metals. Among other commodities, grains yield good returns.

If you are not sure how to start and where to start investing in commodities, start with one commodity and then tailor your asset allocation according to your comfort level.