How to plan for the pre-payment of mortgage loans

The process of applying for a mortgage and then getting it sanctioned, as well as keeping up with timely payments is definitely a hard task. Moreover, a substantial chunk of the debtors’ money goes into these payments and the remaining income is at most times used up completely for other personal expenses. Since mortgage loans take up a significant time to repay, a well-planned person can cover up expenses and yet at the same time be able to repay the mortgage before its time.

An early closure means that the individual would be relieved of a major debt and be able to invest money into other investment forms for future usage. However, pre-closure of loan also means saving up a considerable reserve of money on a regular basis, so that there is no inadequacy of funds at the last minute.

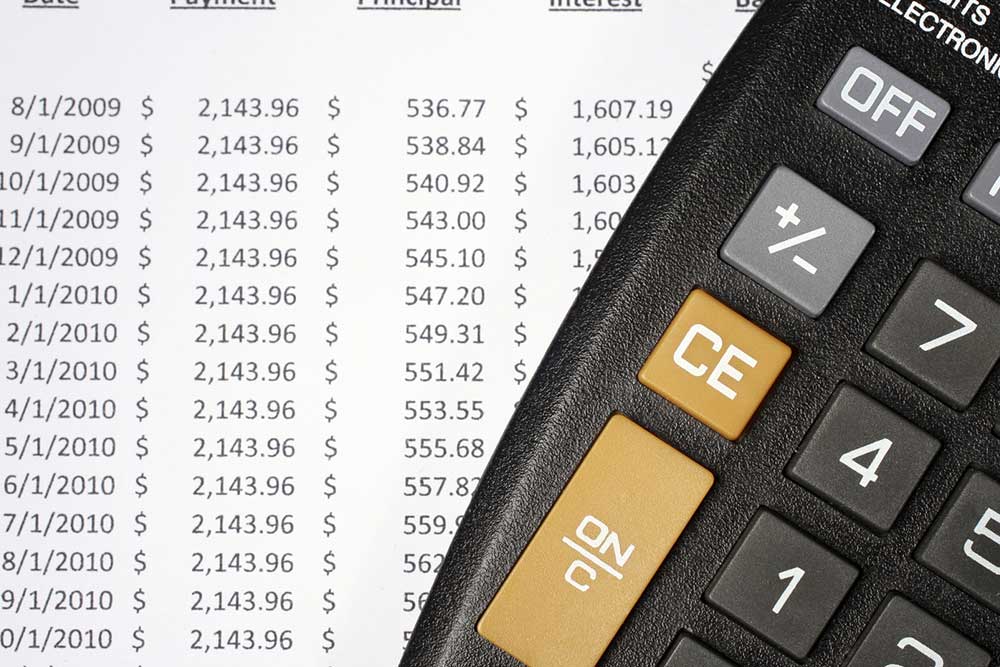

In order to be able to repay a mortgage loan before its time, it is important to consider all the factors including the feasibility. One must remember that an exuberant loan will take the whole time of the tenure or more to repay if the individual does not sort out his or her finances accordingly. Portioning out some amount of extra amount, after taking care of all expenses related to the loan and some for savings can help an individual add an extra sum of money in the monthly repayments.

However, one has to enquire the validity of such extra payments, and inform the creditor in order to ensure that these amounts get reflected in the overall loan balance so as to avoid any confusion.

There is also a possibility that an individual’s earning capability might increase, instead of being stagnant. In such advantageous cases, one can re-evaluate the affordable amount and refinance the mortgage loan with the lender for a shorter repayment period. This will definitely help to repay the loan over a shorter number of years compared to the one that had been planned for a longer stretch of time. In some cases, a debtor could throw in an extra month’s payment into the yearly schedule so as to get ahead of re-payments as well.

While on the negative side, a pre-payment of a loan would mean that the individual has to live on strict finances for a period of time without being able to splurge on other luxuries. But such repayments will be a major benefit for the future as one would not lose too much on interests.