More ways to use mortgage calculators

Mortgage calculators are powerful tools that help you with a lot more than just estimating your monthly payments. Scroll down to take a look at all the additional ways that mortgage calculators help us in.

- If you are new to the whole home buying experience and you have no idea about how much to offer for a house, do not worry as the mortgage calculators are there to help you out even during those initial but crucial stages.

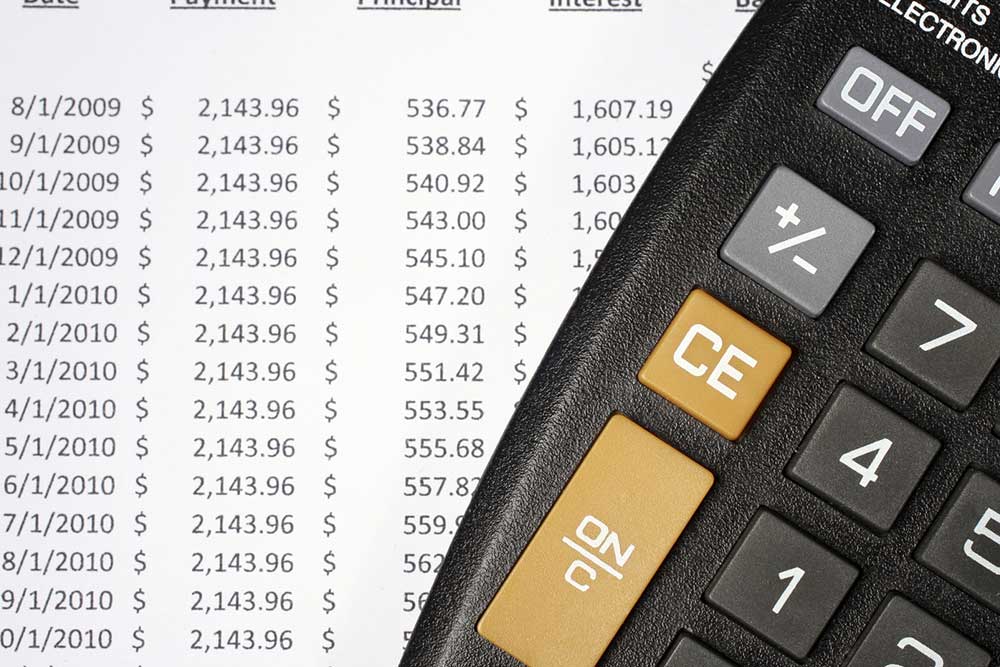

The mortgage calculator can be used as a tool to compare and estimate the monthly payment for different scenarios. By simply changing the home price in the loan calculator, you can if go above, below or stay at the asking price fits your budget. The affordability calculator can also help you out in this area. You can avail the mortgage calculator to see if the impact of making a higher down payment will affect your budget or not. Paying a higher down payment will help in keeping your monthly payments down and also may help you qualify for a lower monthly rate. In some cases making a down payment of about 20% of the home’s purchase price will help you avoid paying private mortgage insurance(PMI). A mortgage calculator’s payment breakdown will show you exactly where your money is going. You can track how much of your money is going towards paying out your principal. It also gives you a monthly statement to show you how you are doing and what will enable you to do better. This way you get to see the total amount of interest that is included with every payment. The 30-year fixed will have the lowest payment amount but the highest interest and vice versa with the 15-year fixed. The interest rate for 5/1 ARM loans are much lower than a fixed rate, but they can change every year. With the aid of the mortgage calculator, you have the advantage to pre determine which type of loan will work out best for you.

Disclaimer:

The information available on this website is a compilation of research, available data, expert advice, and statistics. However, the information in the articles may vary depending on what specific individuals or financial institutions will have to offer. The information on the website may not remain relevant due to changing financial scenarios; and so, we would like to inform readers that we are not accountable for varying opinions or inaccuracies. The ideas and suggestions covered on the website are solely those of the website teams, and it is recommended that advice from a financial professional be considered before making any decisions.