Useful Tips for Beginner Stock Market Investors

A stock market is where people buy and sell stocks. Simply put, you buy stocks of a company based on its growth and earn a dividend. You can also sell those shares later when their prices increase. Although stocks are considered one of the best investments, they can be risky because stock prices fluctuate rapidly. This post lists a few tips on stock market trading for beginners to minimize risk and maximize profits.

Tips for beginner stock market investors

If you are a new investor, follow these stock market trading tips:

Use a stock market simulator

Sign up with a stock market simulator if you do not know how stocks are traded and how the entire system works. These are online tools that help you enter an imaginary stock market. Users create an account, get some fictitious money in hand, and then make simulated investments. This means there is zero risk of losing money. A stock market simulator is a great way to gain knowledge before starting real stock market trading.

Start by investing in index funds

Several types of stocks are traded on the stock market. As a beginner, it is advisable always to start by trading index funds or Exchange Traded Funds (ETFs) rather than stock. ETFs provide greater transparency, come with a lower risk, and are low-cost options. They also help diversify your portfolio. Investing in ETFs and playing it safe is better. You can look for other options as you gradually build up wealth. Be patient and do not expect significant returns initially.

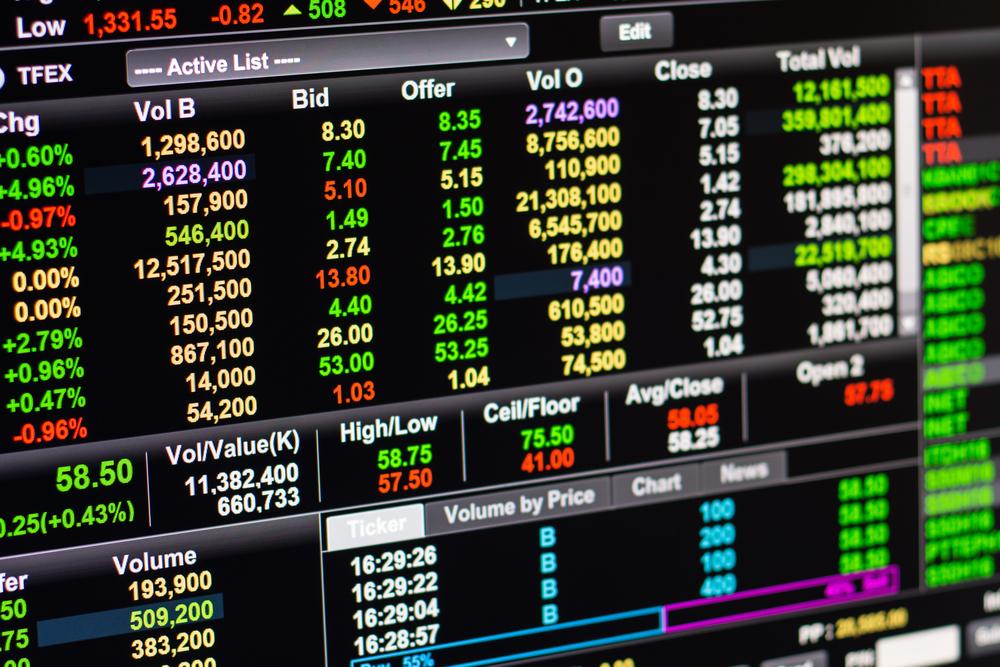

Be aware of the market’s ups and downs

Although stock market trading is among the best investment avenues, it is subject to risks. Investors should be prepared for unexpected downturns that appear from nowhere. One way to prepare for fluctuations is to keep an eye on the stock market indexes, such as the S&P 500 Index and Dow Jones Industrial Average. They track the performance of a group of stocks and securities and can tell which way the market is heading if looked at closely.

Avoid short-term trading

Before jumping into any of the trading methods, it is advisable to understand the differences between them. Two common strategies are short-term and long-term trading. People investing short-term may not have realistic expectations of growing money. Research has proved that several short-term investors have lost money. On the other hand, long-term investors may ride out market bumps and save on trading fees, benefiting over the years.

Use stock market trading apps

Thanks to digitization, we can now buy and sell stocks using our mobile devices or personal computers. Many brokerage companies have their own applications that help you track the prices of stocks, analyze market trends, and provide suggestions to make trading easier. Some also offer charting tools, research options, and current stock market news. The best stock market trading platforms include Robinhood, Fidelity Investments, E*TRADE, Schwab Mobile, Vanguard, Ally Invest, and SoFi. Most of these provide real-time information about the trading position and are easy to use for beginners. However, you need to choose one carefully as per your need.

Tips for choosing the right market trading app

Picking an option can get tricky if you have not used one before. Follow these tips:

Understand the types

Stock market trading platforms are categorized into two types: commercial and proprietary. Retail investors and day traders use commercial platforms. Trading via these is easy, and they come with loads of features, such as real-time stock market updates, educational content on trading, interactive chats, and research tools. On the other hand, proprietary platforms are for financial institutions and large brokers who deal with stock markets for their financial activities. Such platforms are not open to the public for trading purposes.

Check the features

Research the features of the trading platform before signing up. The best ones will have options for level 2 quotes, order size, pricing level, research options, volume assistance, etc. These benefits will be handy once you learn more about the stock market and gain more experience with time.

Check the fee structure

Most trading platforms charge a fee for signing up, commission fees, trading fees, and other charges for using their services. So, compare the rates of different apps and select one that sets a reasonable price for its service.

Verify service quality

Choose an app that has a good reputation in the market. The broker or intermediary should always be in touch with you. Also, any problem in the platform should be solved at the earliest so that it does not affect trading.

Read the various terms and conditions carefully before signing up with a trading platform. The terms may vary from platform to platform. You can apply, open an account, and start trading only when you agree to the criteria they set.