Ways to use mortgage calculators

Mortgage calculators are powerful tools that help you with a lot more than just estimating your monthly payments. Scroll down to take a look at all the additional ways that mortgage calculators help us.

- If you are new to the whole home owning scenario and you have no idea about how much to offer for a house, do not worry as the mortgage calculators are there to help you out even during those initial but crucial stages.

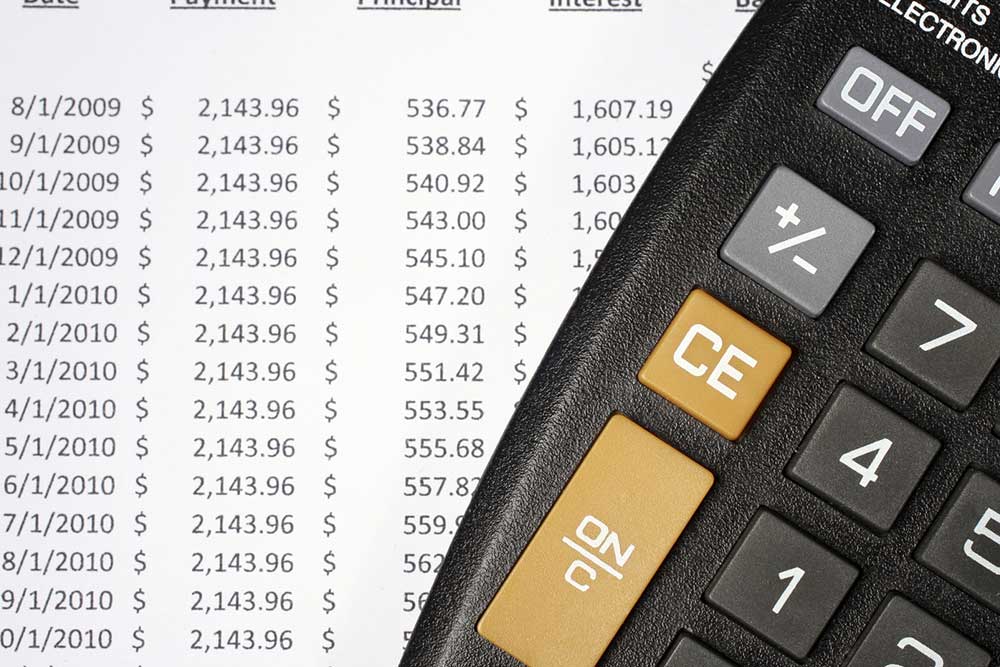

The mortgage calculator can be used as a tool to compare and estimate the monthly payment for different scenarios. By simply changing the home price in the loan calculator, you can see if going above, below or staying at the asking price fits in your budget. The affordability calculator can also help you out in this area. You can avail the mortgage calculator to see if the impact of making a higher down payment will affect your budget or not. Paying a higher down payment will help in keeping your monthly payments down and also may help you qualify for a lower monthly rate. In some cases making a down payment of about 20% of the home’s purchase price will help you avoid paying private mortgage insurance(PMI). A mortgage calculator’s payment breakdown will show you exactly where your money is going. You can track how much of your money is going toward paying out your principal. It also gives you a monthly statement to show you your finances and what will enable you to do better. This way you get to see the total amount of interest that is included with every payment. The 30-year fixed mortgage will generally have the lowest payment amount but the highest interest and vice versa with the 15-year fixed. The interest rates for 5/1 ARM loans are much lower than a fixed rate, but they can change every year. With the aid of the mortgage calculator, you have the advantage to predetermine which type of loan will work out best for you.

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.